Archer Daniels Midland (ADM) is a Fortune 35 firm specializing in food processing and distribution. They recently announced an accounting revision, together with their Chief Financial Officer’s resignation. The accounting revision specifically modified the profit distribution across ADM’s segments and showed that profits at ADM’s were previously overstated. Executive compensation at ADM was tied directly to the Nutrition segment’s performance. Essentially, each executive stood to gain $7.4 million in variable compensation from the misstatement. Archer Daniels Midland’s compensation plan unwittingly created a powerful incentive that improperly assigned profits to the Nutrition segment.

Table of Contents

ADM’s Executive Compensation Package

ADM’s executive compensation was structured with four key components for the 2020 and 2021 fiscal years:

- Straight cash salary.

- Variable cash bonus tied to specific corporate goals.

- Performance based stock units (PSUs) tied to specific corporate goals.

- Restricted stock units (RSUs).

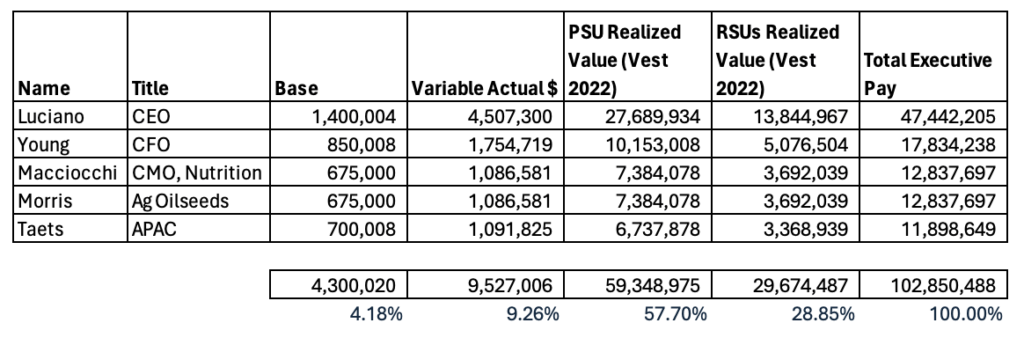

In this case, RSUs refer to stock compensation locked up for a period of three years. Similarly, PSUs refer to stock compensation that requires specific goals to be achieved over three years. When summarizing the total pay package from 2021, it’s clear that the bulk of the total compensation—with a total value of 57%—came from the performance stock units.

Since the accounting fraud occurred on the Nutrition segment’s operating profit, we’ll zero in on the two performance goals tied to Nutrition. Firstly, as measured over 12 months, Nutrition’s operating profit created a variable cash bonus in 2020 and 2021. Secondly, as measured over 36 months, Nutrition’s operating profit caused the awarding of PSUs starting in years 2020 and 2021—the same PSU awards that likely motivated the fraud. We will in turn analyze the compensation resulting from each of these goals.

Archer Daniels Midland’s Performance Based Cash Bonus

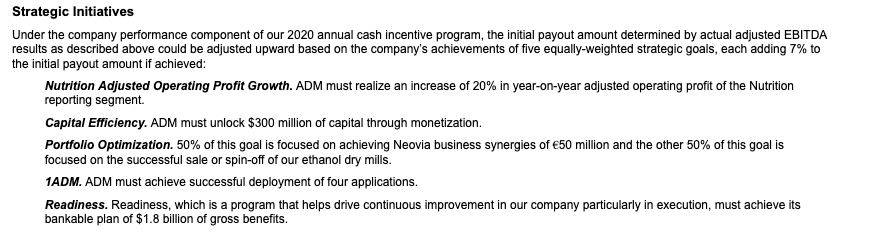

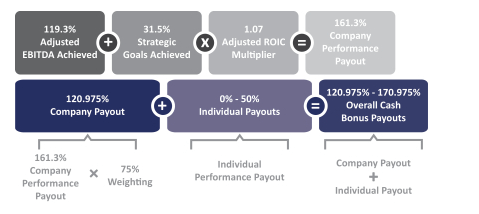

ADM established a variable cash compensation bonus for executives based on Nutrition’s 12-month performance. This bonus was created in 2020 and 2021. From ADM’s 2021 proxy statement, the 2020 cash bonus was based on:

- Adjusted EBITDA against a goal of 3.55B.

- A return on invested capital (ROIC) of 7%.

- Performance against four strategic group initiatives

- Performance against each individual executives’ strategic goals.

The group strategic initiatives were specifically stipulated as:

ADM gives this sort of helpful graph to try and make the variable cash payout more understandable.

In 2020, the Nutrition segment’s performance contributed $335,600 to the total cash bonuses paid out. This contribution is calculated by taking the Nutrition Goal Percentage of 7% * ROIC multiplier of 1.07 * Group Goal Weight of 75% * Total Executive Variable Target of $5,975,000. When split over 5 executives, this cash bonus only equates to about $67,000 per executive.

While $67,000 is a lot of money to most people, the average total pay for 2020 exceeded $20,000,000, which is less than 0.33% of the total compensation paid out for 2020. In 2021, performance against the Nutrition goal did not matter since performance against the EBITDA goal maxed out the cash bonus. Given the small payout due to Nutrition in 2020, and none in 2021, we should probably look elsewhere for what motivated the fraud.

ADM’s Performance Based Stock Units

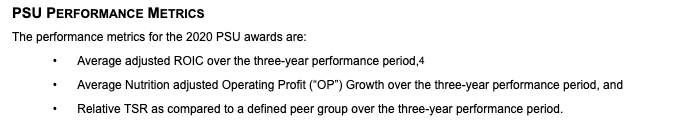

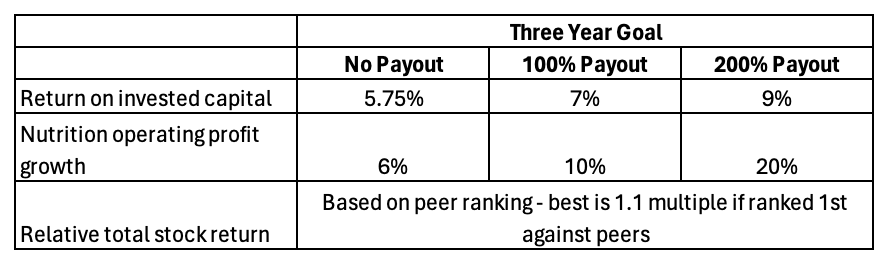

Enter performance based stock units—the smoking gun. The goals used to award performance stock units in 2020 and 2021—again from ADM’s 2021 proxy statement—were:

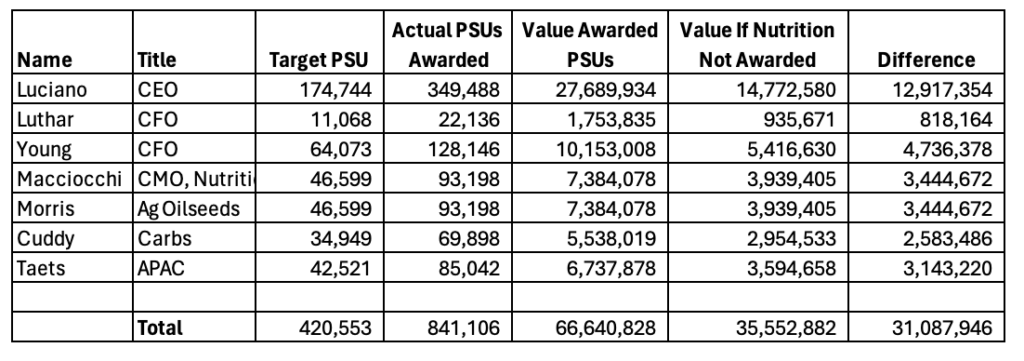

To summarize the actual payout values, I put together this chart:

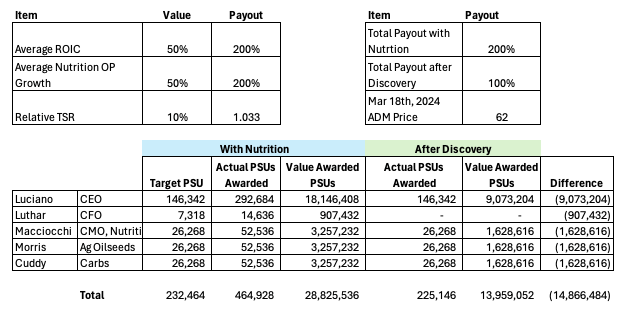

The formula used to derive this is based on \frac{performance\ of\ ROIC + performance\ of\ Nutrition}{2}\cdot TSR\ Multiplier subject to a 200% cap. So if the group has top marks, then they would receive: min(200\%, \frac{200\% + 200\%)}{2}\cdot 1.1) \cdot Target\ PSUs

After three years, Archer Daniels Midland’s executives hit top marks on all three measures. This led to a total payout of 841,106 PSUs—a whopping total of $66,640,000 given ADM’s February stock price of 79.23. The only problem? Nutrition’s performance was overstated. Recalculating the PSU award with no payout for the Nutrition operating profit goal gives a multiplier of min(200\%, 1.1\cdot \frac{200\%+0\%}{2}) = 107\%. The newly calculated PSU award is worth $35,550,000, equating to a difference of ($31,090,000). Seven executives shared this pool, each of them benefiting about $4.4 million dollars on average.

The Nutrition segment misstatement was discovered before ADM’s 2021 PSUs payout. Following a subsequent investigation, ADM paid out the minimum possible 2021 PSUs. Although ADM’s executive team technically qualified for the relative TSR bonus, the compensation committee chose not to pay it, nor did they pay the Nutrition goal. Moreover, Luthar was not awarded any PSUs while on administrative leave. This resultant total payout was $13,959,000 on the 2021 PSUs.

We can model what would’ve happened had the misstatement not occurred. The result is a total bonus of 200% * Target PSUs, with a total PSUs value of about $28,825,000. Spreading the 14.8 million dollar difference across five executives, each lost out on about $3 million dollars.

All in all, each executive stood to gain about $7.4 million dollars from the misstatement regarding the 2021 and 2022’s PSUs. This figure is much more motivating compared to the variable cash compensation!

Problems with Segment Performance

ADM’s executive team had a very powerful incentive to achieve the performance goal operating profits for its Nutrition segment. I’m sure the compensation committee and board saw the nutrition market as strategic towards maintaining ADM’s competitive position. However, performance bonus is a poor choice for measuring segment operating profit, since it’s opaque, easy to manipulate, and hard to manage.

Segment operating profits are simply profits from one division of a company. This seems straightforward to measure. However, the sale price of materials and goods—called transfer prices—between divisions are usually ripe for manipulation and presents a problem. Depending on the intended behavior, transfer pricing of materials between divisions can be set as low as manufacturing cost or as high as market opportunity cost, and anywhere in between. Discussions on the right cost will depend on, and be driven by, excess capacity, operating philosophy, compensation approach, and market opportunities.

While accounting is usually straightforward for the sale of a single product between two divisions, decisions around transfer pricing are usually a complex negotiation. The problem is that the same product might be transferred multiple times, and numerous products might be moving between divisions. By the time several transfer pricing rules have been applied, managers struggle to understand a particular product’s actual profit. So, it’s easy to see that in large organizations with multiple rounds of transfer pricing, segment reporting becomes really opaque.

The second problem with segment performance is that the allocation of corporate overheads and inter-entity overhead transfers heavily influences it. These overhead allocations have large management discretion, and many of the decisions around overhead allocation are a combination of actual performance measurement, firm economics, politics, and compensation.

The final problem with segment reporting is that it’s heavily dependent on the specific computer systems in place. That is, the computer system must change whenever a transfer pricing or allocation regime is changed. These changes eventually start to get crufty and the number of manual adjustments continually pile up. More manual adjustments cause more chances for error and reduces segment performance visibility.

It’s also noteworthy that segment reporting doesn’t really change the overall picture of a firm’s financial performance. Instead, it’s really only helpful for understanding how investments in a firm are performing and how they’re positioned with respect to the market. In my experience, auditors never really take a deep dive into the topic, likely given all the complexities of understanding how everything fits together. All of these issues clearly show why it’s hard to rely on segment operating profit for just about anything. So, the rich performance bonus of ADM’s executive team was essentially tied to a metric that’s opaque, subject to wide management discretion, and concealed manipulation very well. What could possibly go wrong?!?

Archer Daniels Midland’s Nutrition Segment Performance

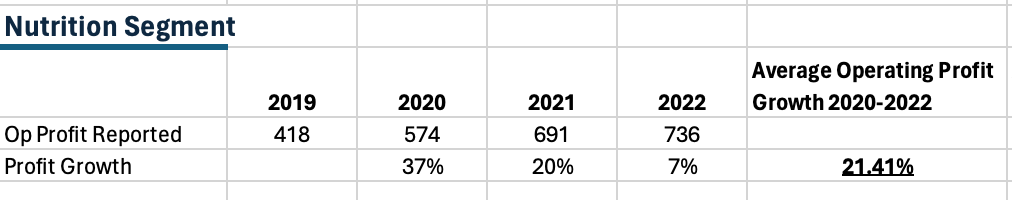

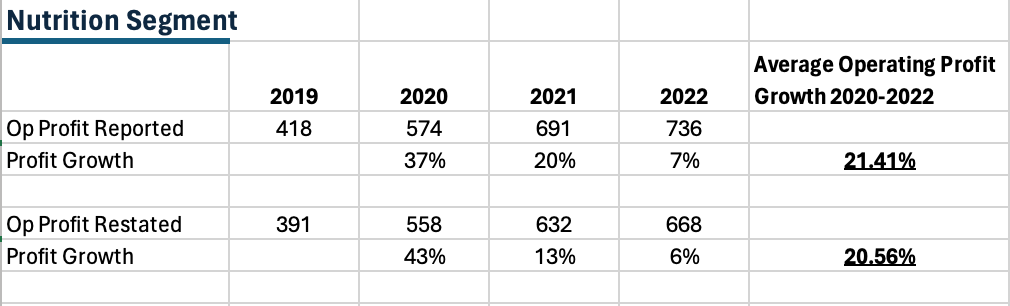

Finally, the smoking gun. Keep in mind that the top end of the Nutrition operating profit PSU goal was 20% growth. As originally stated, ADM showed Nutrition’s segment operating profit to have an average growth rate of 21%. After all, it’d be really suspicious if it was exactly 20%!

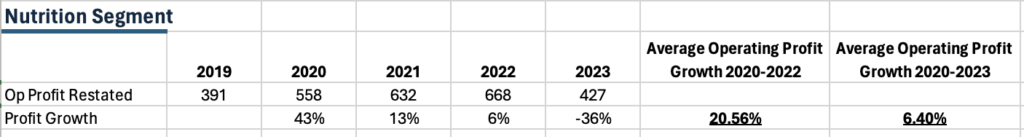

After the restatement, we have a new set of numbers for Nutrition’s operating profit:

Well, that doesn’t look too bad, does it? Operating profit dropped by less than 1%. That’s not the whole story though. In 2023, Nutrition profit dropped by a whopping 36%.

Taken over the four years, Nutrition’s operating profit only averaged 6.40% growth. That’s not really great—had the performance goal been over those four years, then the payout would’ve contributed zero to the executives’ PSU payout.

The massive drop in 2023 is quite suspicious, especially since there’s no significant change in 2020 – 2022. Remember, the executives were already paid out on the 2020 – 2022 performance. By not restating those periods significantly down, management avoided incurring clawback provisions that are part of executive compensation rules. I don’t have enough data to make an informed judgement, but if I were an auditor, I’d be looking for a big bath taken improperly in 2023 to avoid writing down 2020 – 2022.

That this performance manipulation was even discovered at all is also pretty surprising. After all, management receives a wide latitude for segment reporting and it’s an opaque area for most companies. My suspicion is that the CFO pushed the envelope a little too far and a little too blatantly. The overstatement in Nutrition’s operating profit came at the expense of a lower operating profit, primarily within the Carbohydrate division. Maybe the carbs management team realized their profit was lower, which created enough suspicion. Or perhaps the CFO pushed journal entries that were just a little too blatant. After all, JEs would potentially garner more attention from staff accountants or auditors compared to price changes.

Fallout from the ADM accounting scandal

The impact of the scandal has been pretty subdued. The CFO was put on administrative leave and subsequently resigned. ADM made a small r revision of their financial statements. ADM’s stock dropped over 24% after the announcement was made, but has since recovered over half of that drop. All in all, as far as accounting scandals go, it’s not been too destructive to ADM as a whole.

But there’s one small crick yet. The Department of Justice and the Southern District of New York are both investigating this issue, as well as ADM’s accounting practices as a whole. I suspect that they’re probing the apple to see if the whole thing is rotten, or if Nutrition’s operating profit is the only problem; and I suspect they’re trying to find out who knew what and when. While ADM’s CFO was put on administrative leave, he might not be the only person who was in the know or who had knowledge.

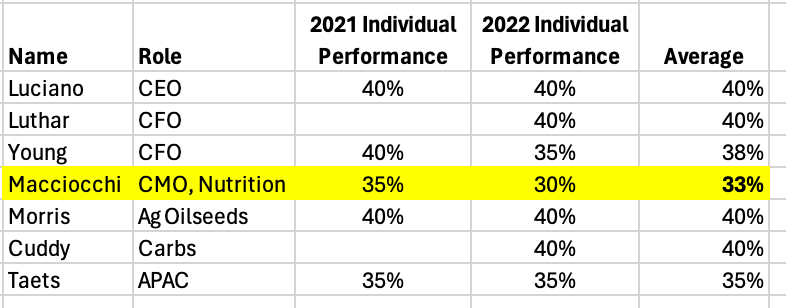

The executive compensation also indicates that people other than just the CFO knew of the deceit. A closer look at the awarded individual performance bonuses reveals that Macciocchi—who is responsible in part for Nutrition—had the lowest score in 2021 and 2022. It seems incredibly contradictory that Macciocchi received the lowest individual performance bonus for managing Nutrition, while the group bonus for Nutrition’s performance was at a maximum value.

If I was highly paranoid (as one reader calls me), I’d suspect the group is punishing Macciocchi for poor performance (since that can’t be tolerated) while awarding themselves the highest group bonus (because you gotta get paid!). But that begs the question: did the group actually know that performance was lagging and just tried to collectively cover it up using clever accounting tricks? Well, let’s leave that for prosecutors at the DoJ and SDNY.

Lessons to Learn

All in all, there are three valuable lessons to learn from this regarding compensation committees, auditors, and investors.

First, if you’re setting executive compensation with a variable component, then be sure to carefully select measures and their respective targets. In this case, ADM had executive compensation tied to segment operating profit. While setting a segment’s operating profit as a goal might make sense, it’s way too easy for management to manipulate the measure’s performance. This concern becomes larger as the variable compensation becomes richer—as was the case here at ADM. Instead, it’s much better to have variable compensation tied to very large and carefully monitored numbers—things such as revenue growth, return on capital, and expense control—instead of segment profit.

Second, if you’re an auditor, you should be very aware of how distorted variable compensation can become and what its resulting impacts might be. ADM’s auditors probably did not pay much attention to segment reporting—after all, it’s not a hugely important metric, is hard to audit, and is not often manipulated. However, it became important once variable compensation was tied to it.

Finally, if you’re an investor, pay very close attention to the types of executive variable compensation, as well as how those numbers might be manipulated. Even though ADM’s actual financial performance probably wasn’t significantly damaged by these accounting revisions, the fact that there was accounting fraud at all did indeed damage their stock price significantly.

Special thanks to my Chicago Booth cohort XP-93 for putting this one on my radar, to Professor Michael Gibbs at UChicago for the lectures that inspired this post, and to JH who edited my writing to make me sound much smarter than I am!