Silicon Valley Bank has entered into FDIC receivership and has for all intents and purposes failed. Here, I argue that SVB failed due to a failure to respond to rising interest rates that impacted both their customer deposits and their investment valuation; and this risk wasn’t well understood in the wider market due to the accounting treatment of their investments.

Table of Contents

Macro Level Overview for Silicon Valley Bank

SVB – the holding company provides commercial banking (Silicon Valley Bank), venture investing (SVB Capital), wealth planning (SVB Private), and investment banking (SVB Securities). SVB brags on their website that nearly half of US venture backed technology companies bank with SVB and 44% of venture backed IPOs bank with SVB. So the bank has a few unique features. First, most of SYB’s deposits and activity are tied to startups and their ecosystem. Second, most of SYB’s customers are businesses and not individuals. These two facts are key to understanding SVB’s failure.

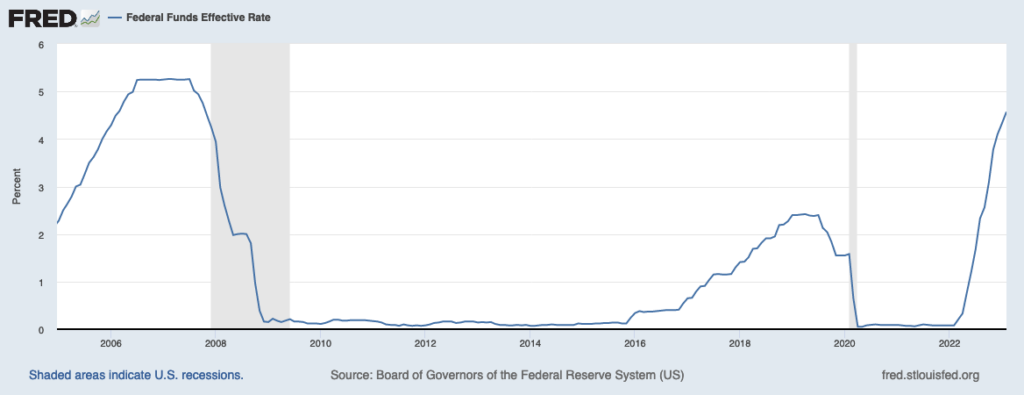

The Federal Reserve, in order to fight inflation, has been increasing the Fed Fund rate or the rate that the Fed will lend money to banks. After the 2008 financial crisis, the Fed cut the rate to close to zero; and slowly started raising rates only in 2016. In response to Covid in 2020, the Fed brought rates back to near zero again; but rapidly increased the rates to over 4.5% by January 2023 to fight inflation.

The change in interest rate has two key effects on SVB. First, the increase of interest rates has led to significantly less cash and activity in the Silicon Valley startup ecosphere. That will lead to fewer customers parking their cash at SVB. Second, in an environment of increasing interest rates, the market value of a held, fixed rate bond will decrease in the short term. These two facts will squeeze SVB.

Understanding Silicon Valley Bank’s Financial Statements

SVB is a public company. That means we can review their most recent financial statement to understand what happened and if this situation could have been foreseen. At a high level, a bank accepts customer deposits (stated as a liability on their balance sheet) and then invests those deposits into assets (stated as an asset on their balance sheet) which generates a financial return. That financial return is then split between an interest payment to the customer and the bank’s profit (which is seen on profit and loss statement). The bank fails when customers lose faith that their deposits will be returned to them – often due to changes in the systemic environment or due to poor investment decisions by the bank.

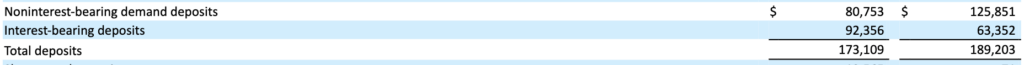

The first item to look at is customer deposits. As mentioned, SVB is unique in that most of their deposits are Silicon Valley startups and firms or individuals in those ecosystems. Due to rising interest rates, fewer startups were being funded, or startups were working with less funding, or startups were simply going under. That led to SVB having significantly less deposits than previously. On page 95, in the balance sheet:

It’s clear that customer deposits dropped from by 9% or 16 billion dollars from 2021 to 2022. To avoid causing panic, SVB, like all banks, has to produce customer funds on demand, and thus the reduction of customer deposits is a drag on cash on hand in the short term. And indeed, on page 99, in the Statement of Cash Flows, the first line in the financing activities is the net decrease in deposits.

Moreover, it’s clear that SVB is paying interests on more deposits versus previous periods. Thus they gain less profit on their investment decisions.

Understand the investment decisions at Silicon Valley Bank

Most of the investments made with customer deposits at SVB are into fixed income investments like bonds, mortgage backed securities, treasuries and so forth. There are a couple of keys to understand valuing fixed income investments:

- The investor – SYB – gives cash to a government, agency, company, etc for a fixed period of time – as short as 1 day and as long as 50 years for instance.

- The investee pays a fixed interest rate on the borrowed funds each coupon period to the borrower.; and the originally invested amount at the end of the fixed time period (called maturity).

- Investors want to pay less to acquire a fixed income investment if the interest rate is increasing. This situation happens because the investor is locking up their funds while they are seeing larger interest rates elsewhere.

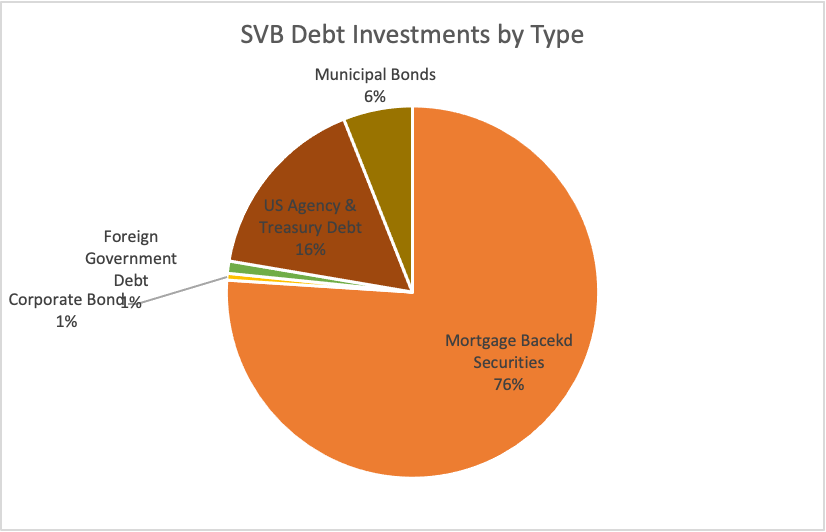

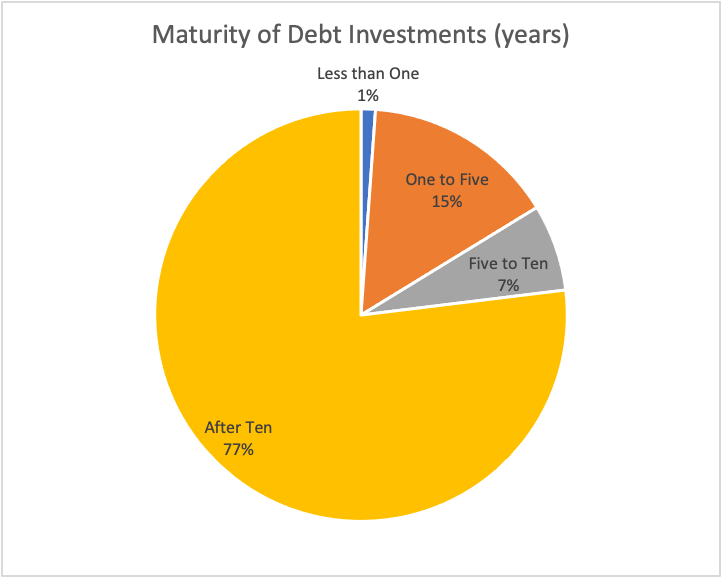

So what investment decisions has SVB made? SVB has focused primarily on debt investments and most of those investments are mortgaged backed securities. This information is aggregated from note 9 in the notes to the financial statements on page 123.

And moreover, most of those funds are tied up with maturities of over 10 years:

So SVB has large investments in debt instruments with long term maturities. It’s hard to understand why SVB choose this investment approach – as we’re about to see, it’s going to blow up on them – but if I were to hazard a guess, they choose these long term debt investments as response to very low interest rates post financial crash and during 2020. In the low interest market, investors struggle to find any income in debt investments; and so SVB tied up their funds long term to get a return. And to continue to speculate, I wouldn’t be surprised if they simply failed to respond to the interest rate regime change.

So how do these investments go wrong at SVB?

So in short, Silicon Valley Bank has smaller amounts of customer deposits creating cash pressure, while SVB has their cash tied up in long term debt. While that sounds bad, it should be fixable – SVB could sell their debt on the open market; and use the proceeds to pay back depositors who are withdrawing cash. But there is one wrinkle – the long term debt is not as worth as much as it was purchased for. Remember that in an increasing interest rate environment, the short term market purchase price of most debt instruments goes down.

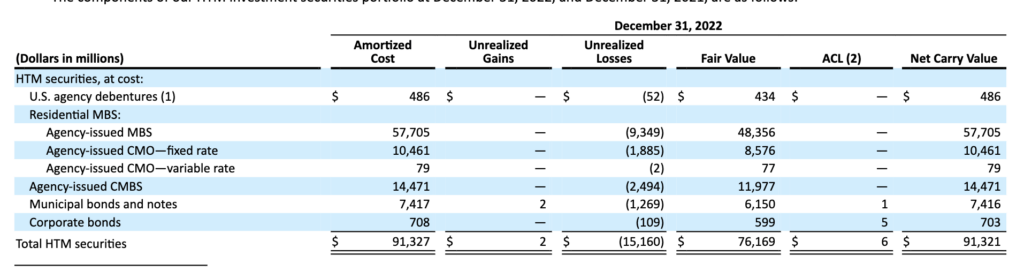

So in the financial statements, in note 9 again, aggregating the unrealized losses on debt, Silicon Valley Bank has lost 17,693 billion or 17% in value on their investments as currently valued by the market.

Why weren’t these losses noticed sooner?

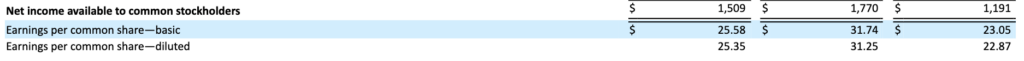

Looking at the 2022’s net income and earning per share on page 96, it seems like SVB is healthy:

Of course, looking solely at net income and EPS is highly reductive. In particular, the accounting treatment of debt securities is really crucial. Accountants usually value assets on a historical cost less impairment. That means if I buy a stock on day 1, for a value of 50, and its price goes up to 60 on day 2, I only value the stock at 50. But debt investments can get three different possible treatments.

| Type | Valuation | Unrealized Gain or Losses treated as: |

| Held for Trading – debt is going to be traded in short term | Mark to market | Net Income |

| Available for Sale – debt might be traded in short term | Mark to market | Other comprehensive Income |

| Held to Maturity – debt will be held until it matures | Historical | None |

Debt held for trading for instance means that each period, the current carrying value of the debt is marked up or down to the current value on the market; and the unrealized gain or loss is taken to net income. Crucially, debt that is held available for sale (AFS) has gains or losses treated as other comprehensive income which is not part of net income; and debt held to maturity (HTM) doesn’t show any gains or losses.

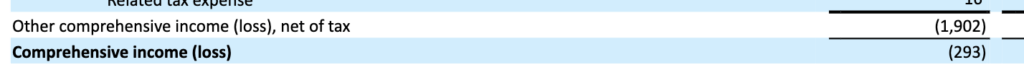

Silicon Valley Bank treats 75% of their debt as HTM. Thus it’s not marked to market and the unrealized gains and losses don’t show up in net income. The other 25% is held AFS. So if we look at Silicon Valley Bank’s other comprehensive income: now a part of the problem is obvious.

And the problem is even more obvious when looking at the unrealized loss of 15 billion on HTM debt securities. This 15 billion dollar loss does not show up in net income or other comprehensive income! And it’s a magnitude bigger than the 1.5 B net profit SVB claimed!

And normally, that accounting treatment wouldn’t be a big issue – bonds held to maturity will be paid out many years in the future at the full value of the bond after collecting many interest payments. The problem for Silicon Valley Bank is that they need cash now.

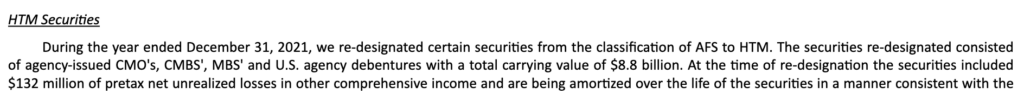

Moreover, Silicon Valley Bank actively converted some debt investments from AFS to HTM. On page 125, note 9 again:

SVB reclassed some of the assets to HTM which moves the unrealized gains and losses from other comprehensive income to not having any income impact for unrealized gains or losses. The accounting here is complicated, but Silicon Valley Bank probably reduced their losses in other comprehensive income with this reclassification.

I’m not accusing SVB of doing anything wrong here, but I would imagine auditors and regulators are going to look carefully at that reclassification.

Conclusions

So Silicon Valley Bank failed dramatically due to (1) their deposits being reduced by fewer startups having less cash due to rising interest rates; and (2) debt investments becoming less valuable in the short term due to rising interest rates. Moreover, seeing the reasons for the failure was harder due to the accounting treatment of their debt.