Non Profits are usually funded through individual donations or grants. Grants are usually larger sized funds and require grant budgeting and careful accounting to show how the granted funds were planned for and used. With QuickBooks Online, non profits can track how they used the grants that they received.

Table of Contents

Overview of Non Profit Grant Budgeting

Grants will come from either a governmental entity, another funding organization, or sometimes from an individual. Most grants have specific outcomes tied to them and require a grant application that includes a budget to explain how the grant funds will be used. Donors use the application to figure out what organizations they want to fund.

Donors are also responsible for tracking how the funds they granted were used. Thus, most grants will also require one or more reports that show the outcome of the grant and how the grant was used. Ideally, most of the funds used will track similar to the budget used in the grant application, though small differences are the norm. Any left over funds are usually proposed as follow-on activities to the grantor.

Grants are also connected to the idea of restricted funds. Restricted funds are donations that are tied to a specific purpose and have to be reported separately on both an organization’s 990 and on it’s own financial statements.

Depending on the size of the grant and the organization, non profits can either track grants manually in a spreadsheet or in QuickBooks Online using Customer Projects. This setup should be carefully considered in conjunction with the chart of accounts as well.

Grant Budgeting without QuickBooks Online

Tracking a grant for a small nonprofit or a small grant can be done offline from QuickBooks Online or other accounting package. In this approach, a budget for the grant is created in a spreadsheet such as Microsoft Excel. Each expenditure against the grant has to be accounted for twice – once in QuickBooks Online for the organization’s overall finances and once in the grant spreadsheet for the grant’s budget.

The key to making this method work is to ensure that every expense that is tied to a grant is both in QuickBooks and the grant budgeting spreadsheet. At each month end, the accountant should verify that no expenses were missed in either. Finally, to account for restricted assets at the end of the year, the accountant can review the grant budgeting spreadsheet to make entries for restricted funds.

This method is simple and straightforward, but it does lead to a lot of duplicate work and it’s easy to make a mistake. This method is appropriate for organizations that are small, have either a small number of grants, and the grants tend to be completed in the same year that they’re issued. More complex organizations with multiple, multi year grants should consider using QuickBooks Online’s customer project functionality instead.

Grant Budgeting with QuickBooks Online

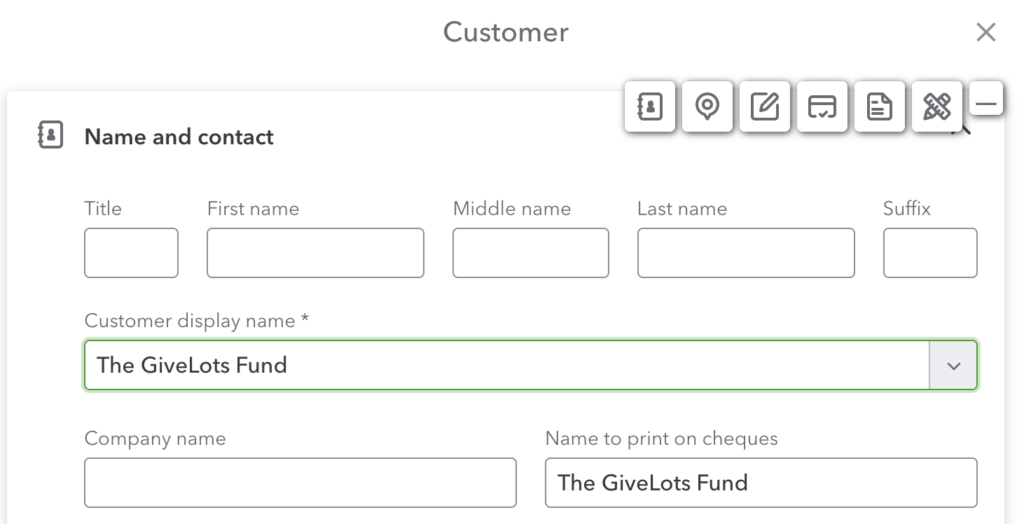

Grant Budgeting is managed in QBO via projects. In QBO’s project setup, each project is tied to a customer. To flip this to the nonprofit world, each grant is tied to a grantor. The setup is pretty straightforward. First, projects must be turned on in QuickBooks Online. Second, the grantor should be setup as a customer.

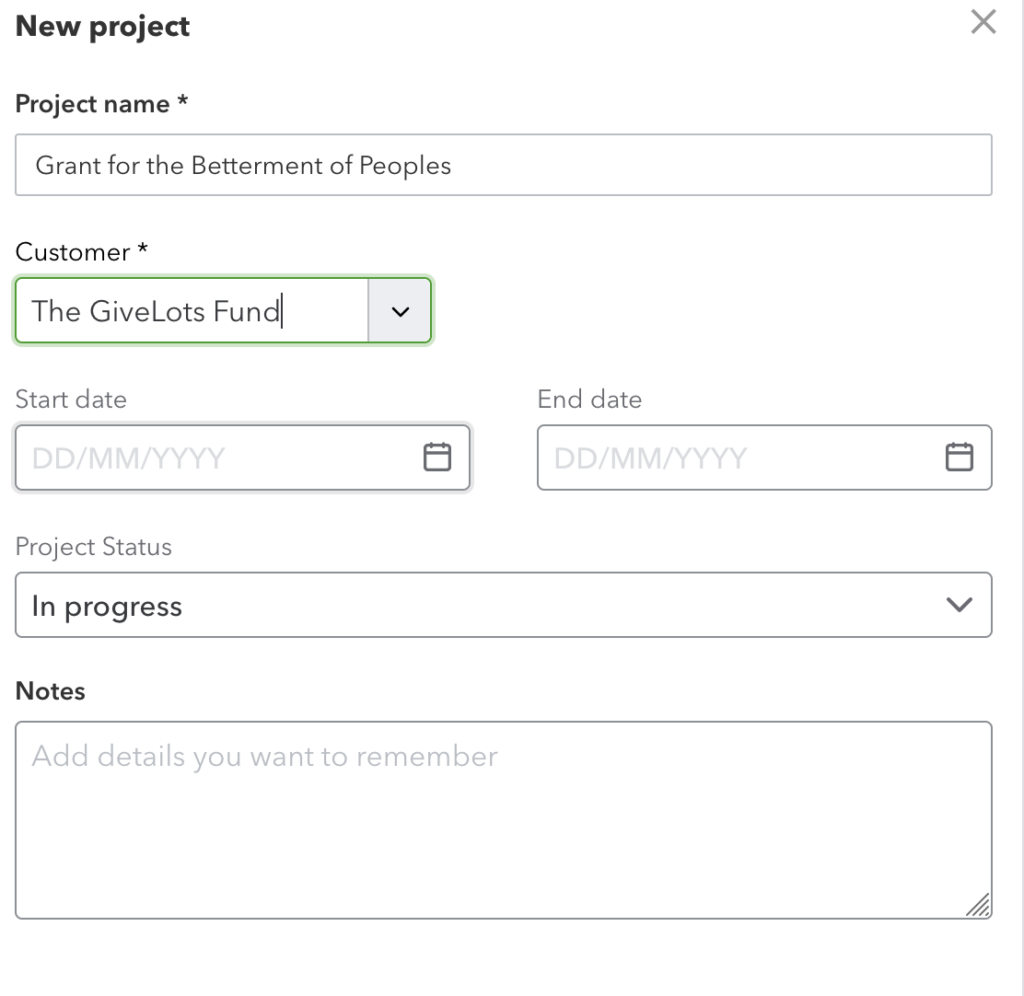

Finally, each grant should be created as a project in QBO. Most non-profits will perform this step once a grant is approved by a grantor.

Many older tutorials for QuickBooks and QuickBooks Online suggest using the classes for this tracking. Classes are usually better used for the 990 functional expense breakdown. Classes also become really unwieldy for handling many grants.

Once the project is created for the grant in QBO, the grant budget can then be setup. Here, there are multiple options. The easiest way to set this up is to create one budget in QBO per grant. This approach makes the most sense as most grants will have different start and stop dates. Sometimes, multiple grants are interrelated – say two grantors are syndicating to fund a nonprofit. In this case, having all of the grants on one budget may make more sense.

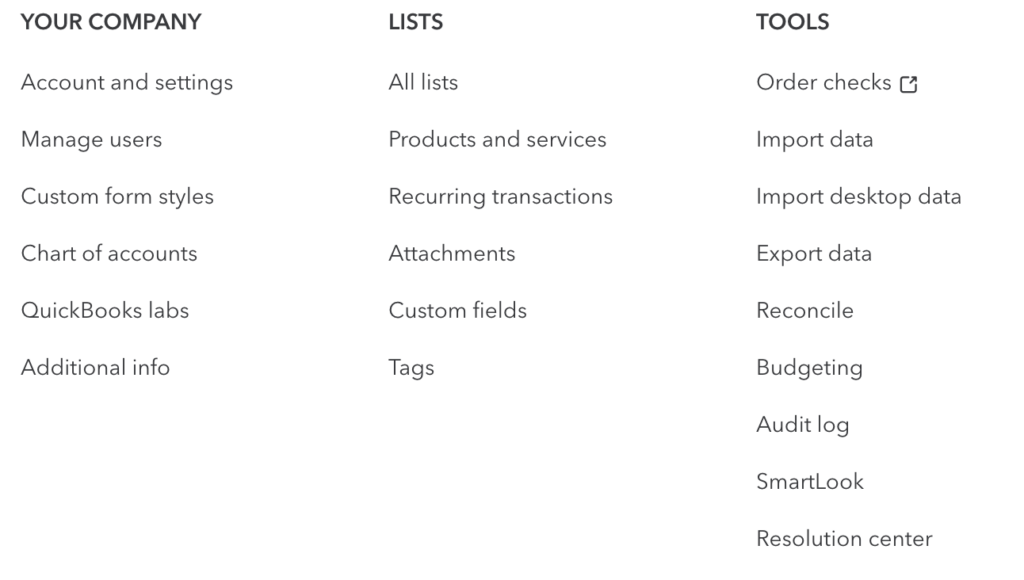

To setup the grant budget in QuickBooks Online, first click the gear icon in the upper right corner and then under Tools, select “Budgeting”.

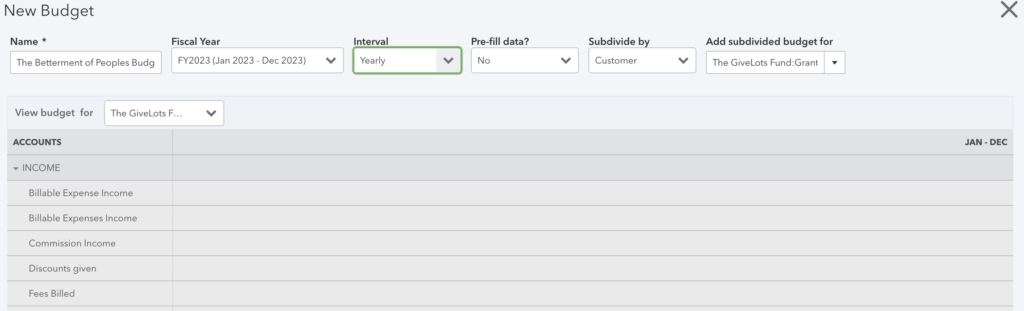

Next, you’ll enter the basic information on the grant. Be sure to select “Subdivide by” and “Customer and then select the customer and grant.

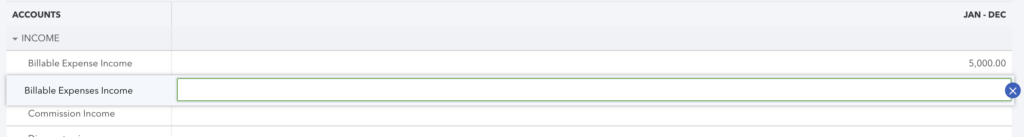

You’ll then be taken to a screen where you can enter in the budget values for each account.

Usually, it’s best to put both the revenue (incoming funds) and outgoing expenses in the grant’s budget. That approach has two advantages. First, when running reports on actual versus budget, if the grantor missed sending a payment, it’s very obvious. Second, having a budgeted income number is very helpful for performing restricted asset analysis for financial statements.

Once the project is setup and the grant budget entered, to assign revenues and expenses to the grant budget, the bookkeeper selects the project on each line item entered that is relevant to the grant. The real key here is to be sure that each line item is correctly tied and no expenses are missed.

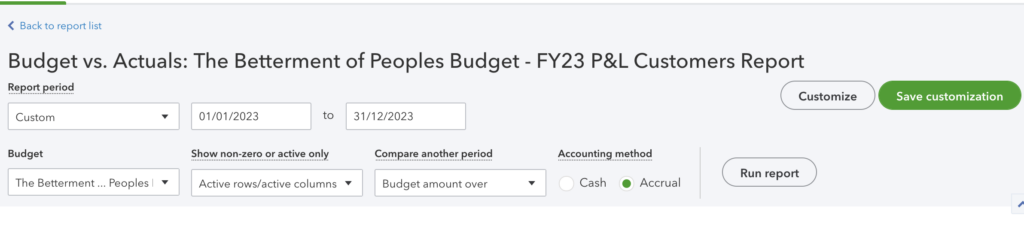

The last step is to setup reports in QBO for the budget versus actual comparison of the grant. QuickBooks Online delivers a “Budget vs Actuals” report under “Business Overview” in the reports section. Running this report is then as simple as selecting the period and the budget.

If the funds on grants are considered restricted and some will remain at year end, running the Actual vs Budget for each grant will then provide the necessary values for the restricted analysis. This approach is usually easiest accomplished offline in spreadsheet; but can also be done using the location field. That’s a post for another day though.

Conclusion

Non Profits who are funded via grants need to provide reports to their donors. There are two ways to build these reports. First is to track each relevant grant revenue and expenses in both a separate grant spreadsheet and in QuickBooks Online. Second is to track the grant revenue and expenses in QuickBooks Online using projects.

Learn from other Non Profit Leaders!

Talk with other nonprofit leaders, learn from their experience, and access other key resources!